I waited on line for approximately ten minutes to speak to Bob Richards. After I thanked Manulife 乐活计划 him for his fine seminar we spoke briefly. Mr. Richards asked me what my position with Chubb Colonial life was, I answered, "oh I am just an Agent." With that Bob Richards said, "you must never, ever say that you are just an Agent, John, you are very important to this Company. John I want you to read a book as soon as you go home, all right?" "Of course Mr. Richards," was my response.

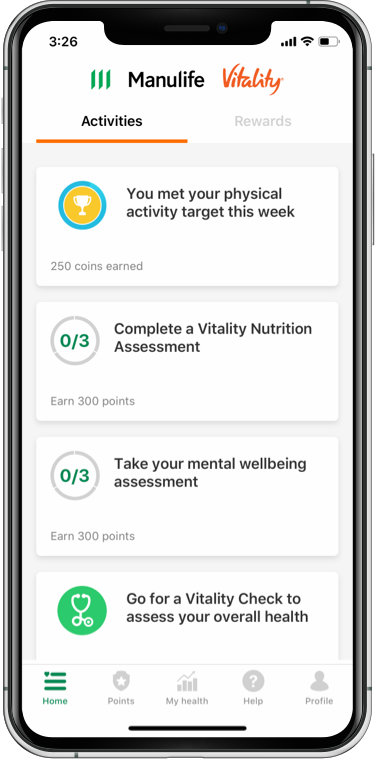

The idea is to give them more value with lower price. if a product is $100 and you give it 20% discount to $80, this will make them think they got a $100 worth of product for just $80. Wow a Manulife Vitality Plan great offer.

Think of a three-legged stool. With all three legs planted firmly on the ground, it is stable and balanced. Remove one leg and it is no longer stable.

Presidential Life (PLFE), which is listed on NASDAQ, is a Nyack, New York-based company that offers various types of insurance products including graded benefit life insurance, universal life, whole life, term life , Of single premium annuities, single premium deferred annuities, single premium immediate products, annuities and flexible premium group annuities terminal funding. It has a P E of Manulife Vitality health program and a yield of

There are various "types" of travel insurance. I am not talking about baggage insurance, or trip cancellation insurance, I am talking about what could happen if something happened to you. Although the other items are "important" as there is a financial interest at stake if something happened to your stuff, or your vacation, but what if something happened to you? Have you ever thought how much that would cost? One thing I can guarantee, it would cost more than the replacement cost of your belongings.

This family's example we shows 18 years of income need. Insurance companies usually don't have an 18-year level term product. Usually, they will offer ten, fifteen or twenty year terms policies. In this example, we would recommend buying either a 15-year or 20-year level term insurance policy. Decide which one to buy based on your own analysis of your family's needs. Your final analysis will determine the length of time you will need this insurance.

Whatever you do, do not fail to get and compare quick auto insurance quotes. This is very important if you would find affordable auto insurance policies. Get your quotes now.